Steps to apply for TCC Code to File 1099s Electronically

Important: To the best of SGA's Knowledge, this is the process. SGA does not assign the TCC Code. Any questions should be directed to the IRS.

Starting tax year 2023, if you have 10 or more information returns, you must file them electronically.

Tax Year (TY) 2026/Filing Season (FS) 2027 is the targeted date for the retirement of the FIRE System. • The Information Returns Intake System (IRIS) will be the only intake system for information returns currently received through FIRE, for the 2027 filing season.

The Information Returns Intake System (IRIS) is a free online portal that allows you to e-file information returns for tax years 2022 or later. You will need an employer identification number (EIN) and you must apply for an IRIS TCC. Once you get your TCC, you can e-file information returns with IRIS. Please allow 45 days for processing an IRIS TCC code application.

The IRS encourages transmitters who file for multiple issuers to submit one application, select the transmitter role, and use the assigned TCC for all issuers. The purpose of the TCC is to identify the business acting as the transmitter of the file. As a transmitter, you can transmit files for as many companies as needed under one TCC.

To complete an application for an "IRIS" TCC:

To use the IRIS Taxpayer Portal, you need an IRIS Transmitter Control Code (TCC). This 5-digit code identifies your business when you e-file forms. It can only be used for IRIS.

Note: Before applying, please review the tutorial, which provides step-by-step instructions for applying for an IRIS TCC.

Sign in: To access the IRIS Application for TCC, click the ‘Access IRIS Application for TCC’ option at irs.gov/iristcc

Create a new account or sign in with an existing account.

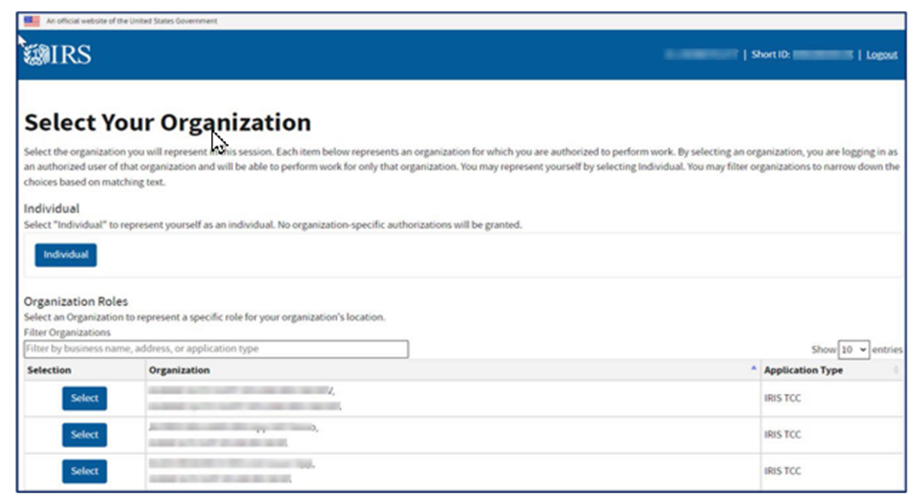

The system will direct you to the Select Your Organization page. On this page, you will select the firm/organization you are representing.

If you selected a firm/organization on the Select Your Organization page, you will only see the application affiliated with that organization.

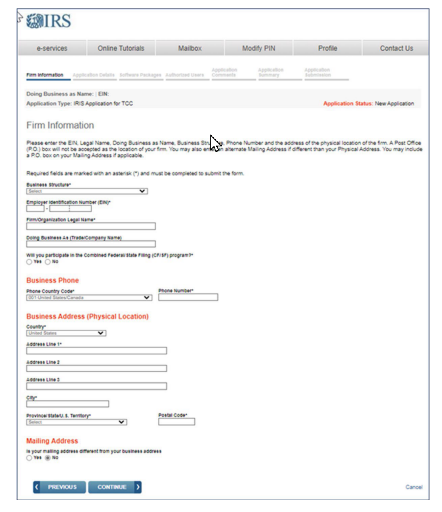

Firm Information Page: Select your business structure from the drop-down menu.

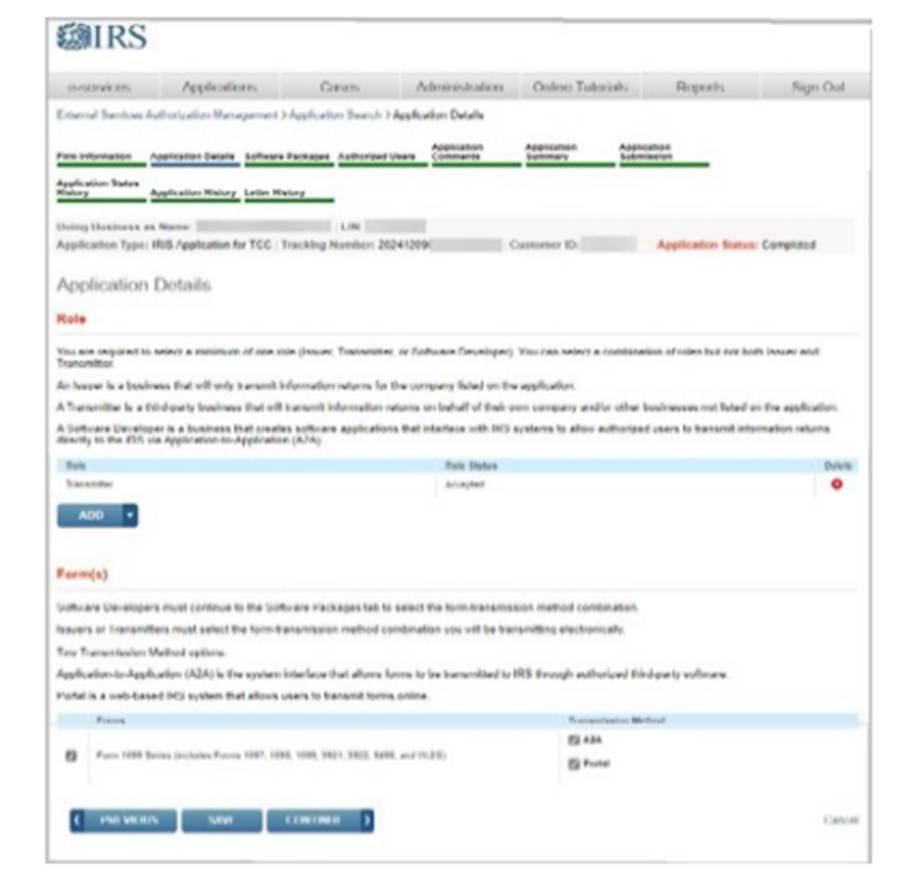

Application Details Page: Select from the applicable roles by checking the box next to the forms you will be supporting and the corresponding transmission method(s).

- Issuer: A business that will only transmit information returns for the company listed on the application.

- Transmitter: This designation typically allows you to transmit your own company's information returns in addition to having the option to transmit for other companies in the future.

Software Packages Page: Only completed if you are a Software Developer who will create software applications according to IRS Specifications.

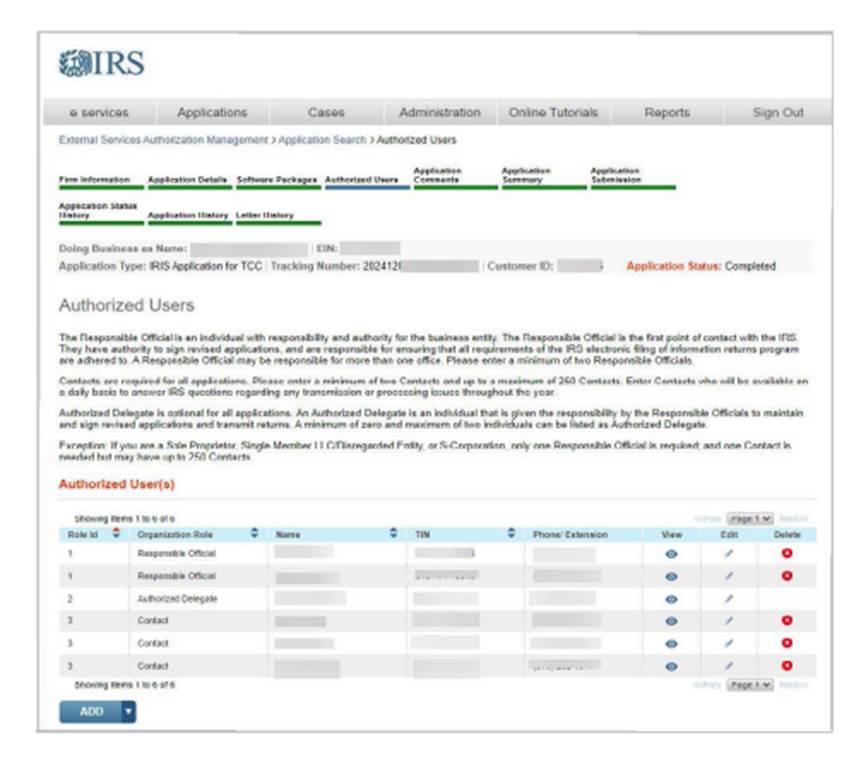

Authorized Users: Add the Responsible Officials (ROs), Authorized Delegates (ADs), and Contacts required for the IRIS Application for TCC.

- ROs are individuals with responsibility for and authority over the business entity. ROs are the first point of contact with the IRS. They have the authority to sign original/revised applications and are responsible for ensuring that all requirements are adhered to. At least two ROs must be listed on the application unless you are a Sole Proprietor or Single Member LLC . All ROs will be required to sign the Terms of Agreement. An RO can also be a Contact on the application.

- ADs are optional for all applications. An AD is an individual that is given the authority by the ROs to maintain and sign a revised application and transmit returns. A minimum of zero and maximum of 2 individuals can be listed as AD. An AD can also be a Contact on the application but can’t be an RO.

- Contacts should be available for inquiries from the IRS on a daily basis. There is a minimum of 2 required contacts, unless you are a Sole Proprietor or Single Member, LLC and a maximum of 50 contacts allowed per application. The Contact listed on the application does not have to be the individual listed as a Contact on the information return.

To add ROs, ADs, or Contacts, select their user role from the Add User option and complete the required information. The individual will be listed on the Authorized User(s) grid.

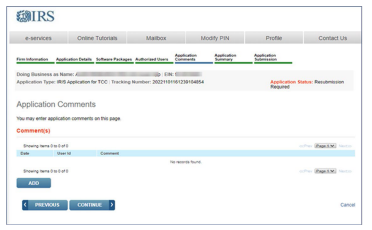

Application Comments: To add comments to the application, select the Application Comments tab at the top of the page, and click Add at the bottom of the page. In the pop-up window, enter your comment and select Save.

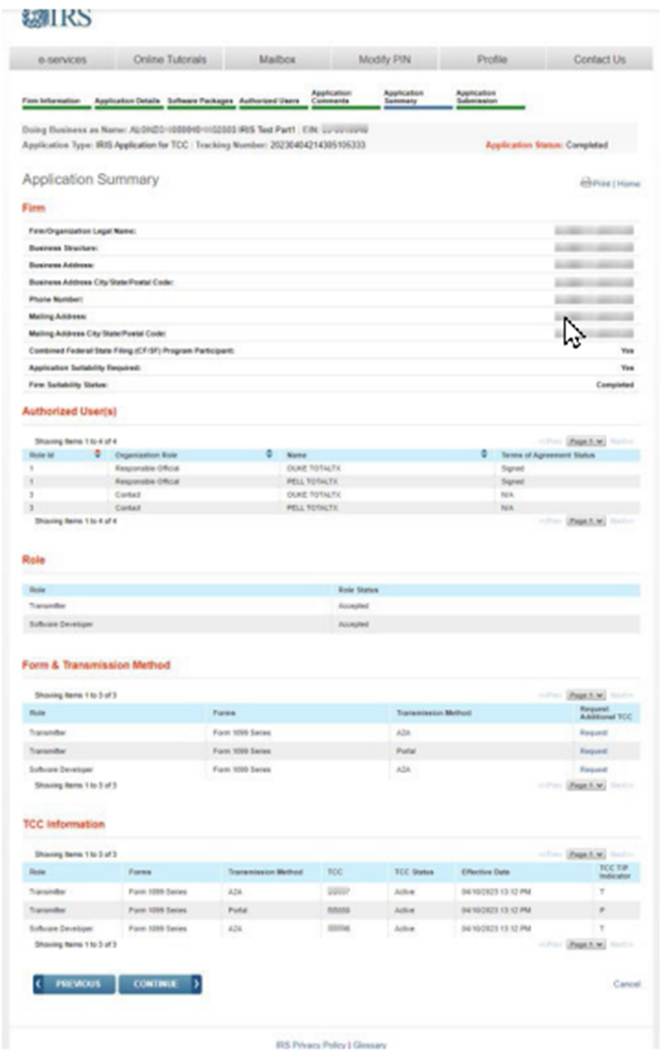

Application Summary: Verify all information is correct before selecting continue to complete the Application Submission page. If information needs to be revised, use the toolbar along the top of the page to navigate to the appropriate page. Update the information and select Save. Once the application is in Completed status, the TCCs and/or Software IDs will be visible on this page.

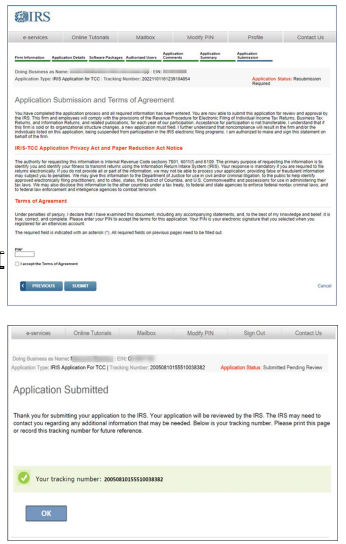

Application Submission: Each RO must sign the Application Submission page using their 5-digit PIN.

The application will be processed after all ROs have entered their PIN and accepted the Terms of Agreement.

An AD cannot sign an application until the initial application goes to Completed status.

After the last RO has completed the Application Submission page, Application Status displayed on the upper right will be Submitted Pending Review.

If the application is incomplete due to a missing RO signature, the application will be saved pending signatures and the Application Status will be Signature Required.

The ROs who have not signed the application will need to complete the Application Submission page before the application can be reviewed and TCC(s) be issued.

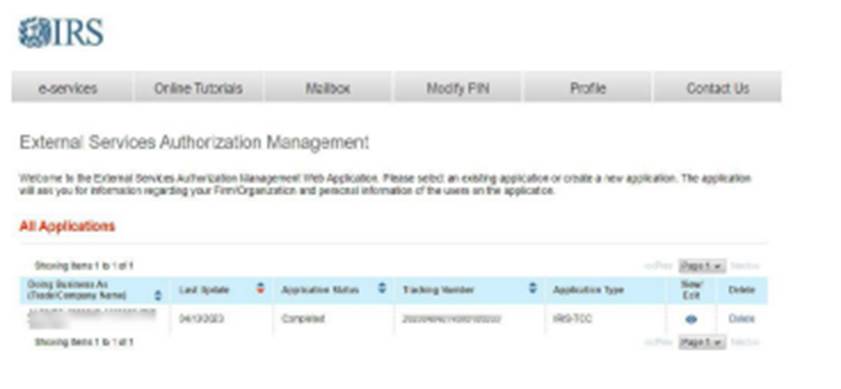

Review/Modify an existing IRIS Application:

After the application moves to Completed status, updates can be made as needed by the ROs or ADs.

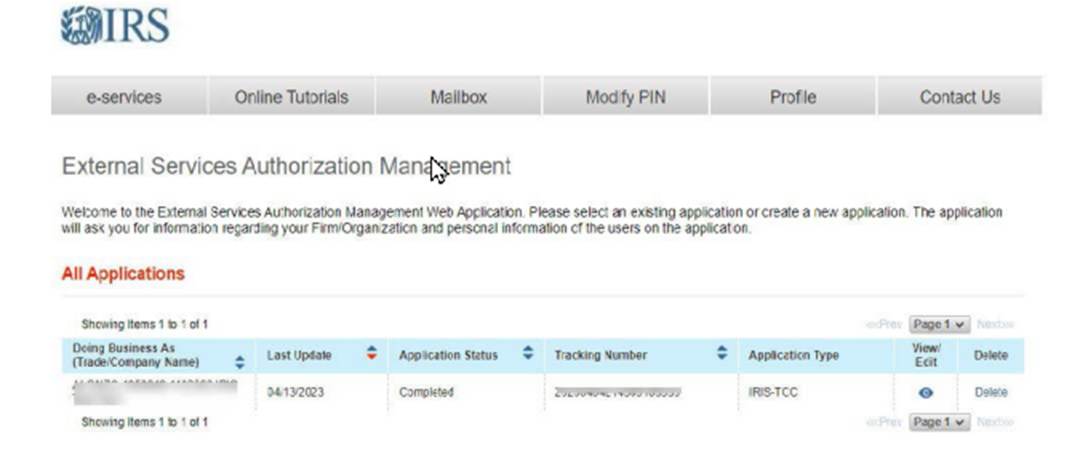

Sign in and select the application by selecting the eye symbol icon under the View/Edit column for the Organization.

This will launch the Application Summary page to modify or review the application.

If the application is in Completed status or has been in Completed status, the TCC(s) will be displayed on the Application Summary page under the TCC Information section.

To revise the application, select the page using the toolbar. Some changes will require all ROs or all ADs on the application to re-sign the Application Submission page. ■ Firm’s DBA Name ■ Role changes or additions ■ Software Developer Package Type.

Modify your PIN

To modify an existing PIN, select the Modify PIN tab located at the top of the screen. Enter and complete the required fields. The newly created PIN can be used immediately to sign the IRIS Application for TCC. A prior PIN is not needed to create a new PIN.